Demographics

Economic Impact

- Lone Star College adds nearly $3 billion annually to the Houston economy with higher student incomes and increased business productivity.

- Students will receive a present value of $1.9 billion in increased earnings over their working lives. This translates to a return of $6.00 in higher future earnings for every dollar that students invest in their education at LSC. The corresponding annual rate of return is 19.9%.

- The state of Texas will receive an estimated present value of $11.1 billion in added state revenue over the course of the students’ working lives. Texas will also benefit from an estimated $182.7 million in present value social savings related to reduced crime, lower welfare and unemployment assistance, and increased health and well-being across the state.

- Taxpayers provided $388.9 million of state and local funding to LSC in FY 2022-23. In return, taxpayers will receive an estimated present value of $716.3 million in added tax revenue stemming from the students’ higher lifetime earnings Investment analysis and the increased output of businesses. Savings to the public sector add another estimated $67.3 million in benefits due to a reduced demand for government-funded social services in Texas.

View the full Economic Impact Report (pdf)

Additional Reports

View the Analytics & Institutional Reporting website

View the Institutional Effectiveness website

Budget 2025-2026

$548,000,000

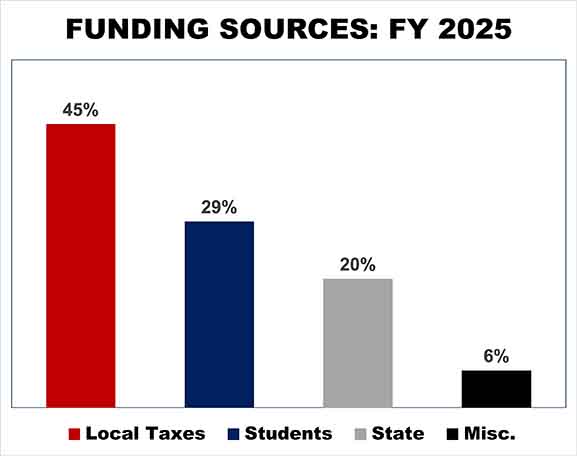

Funding Sources 2025-2026

Property Tax - $244,500,000

State Funds - $111,000,000

Misc. Activities - $32,000,000

Tuition and Fees - $160,500,000

Property Tax Rates

Maintenance and Operations - $0.0785

Interest and Sinking - $0.0275

Tax Rate Total - $0.1060

Bond Rating

Standard & Poor's Global Ratings' assigned its 'AAA' long-term rating to Lone Star College System on May 5, 2020. At the same time, they affirmed their 'AAA' rating on the LSCS existing (GO) debt.

Click here to view the report.

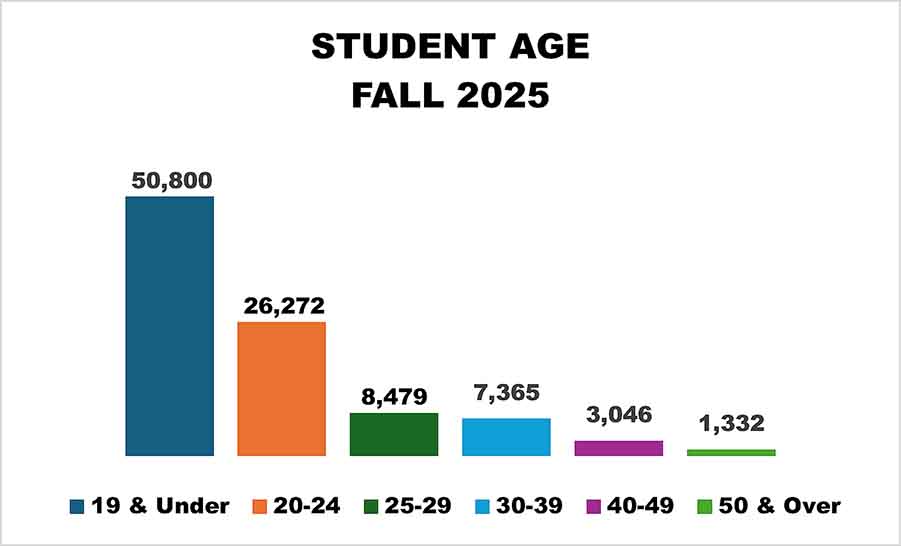

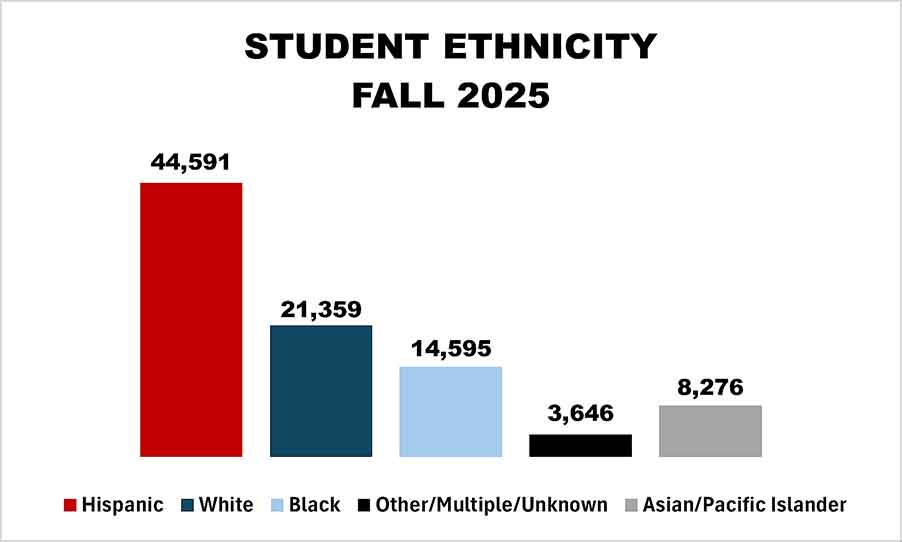

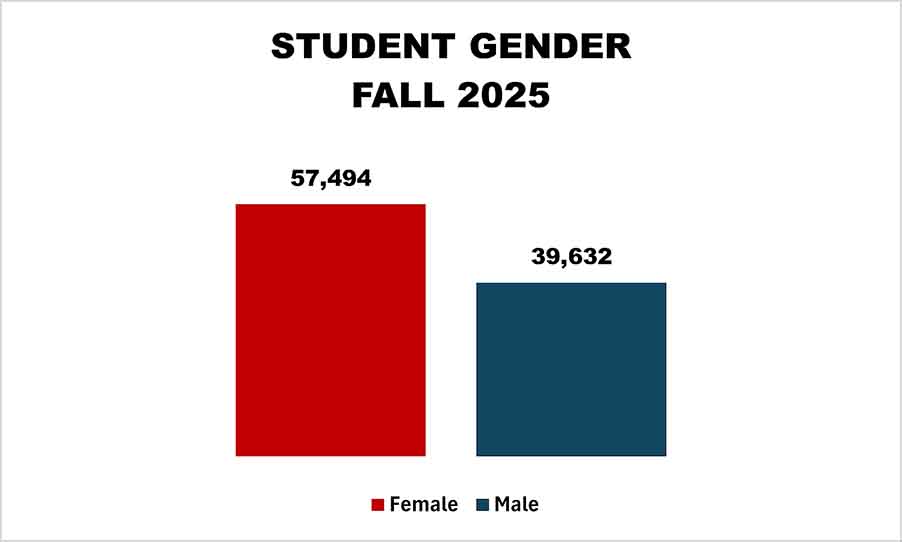

View Fall 2025 enrollment report

View Fall 2025 enrollment report