How to participate in the Employee Giving Campaign

There are three ways in which you can support the Employee Giving Campaign:

1. CASH OR CHECK DONATION:

You can send a check or cash donation in a sealed envelope to the Foundation Office via interoffice mail. If you choose this manner, please be sure to detach and complete the portion of your brochure entitled "To make a one-time donation." Also, if you choose this method, you will need to find your preferred fund designation by clicking HERE and include it in your form. You can write your check to "LSC Foundation."

2. ONLINE DONATION:

Click HERE to make your one-time donation online. If you choose this method, you will need to find your preferred fund designation by clicking HERE and include it in the "Comments" section of the online form.

3. PAYROLL DEDUCTION:

This is the most time efficient way for employees to participate in the Campaign, and for the Foundation to process your donation. Additionally, it has proven to be the way to generate the most dollars for our students. Setting up payroll deduction is easy:

A). Log in to myLoneStar.

Click on Payroll & Compensation, and then click on Voluntary Deductions.

B). Check your Payroll Deduction Status.

If you are already participating in payroll deduction, your Status will appear below as Currently.

- If you are satisfied with your deduction as it currently appears, you are done!

- If you want to make a change, click on Edit and follow the instructions that appear.

- If you do not see a voluntary deduction like below, click on Add Deduction and follow the instructions that appear.

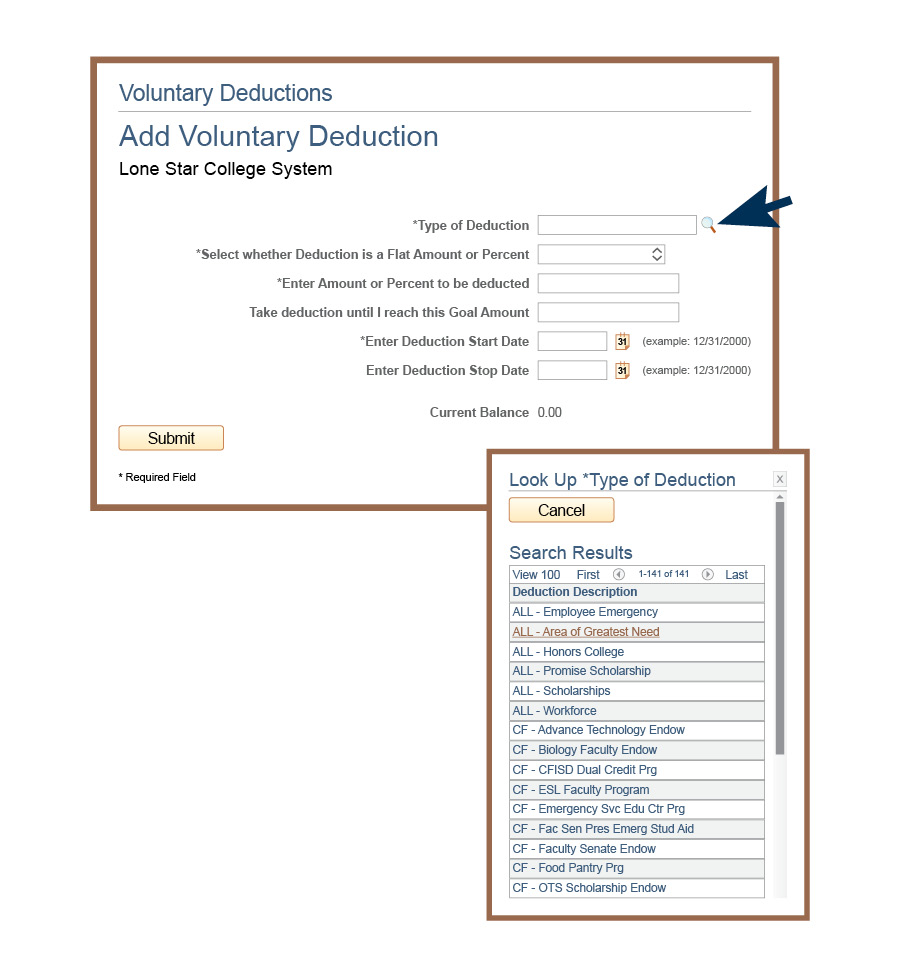

C. Complete the NEW & IMPROVED Voluntary Deductions Form. Please note:

- For Type of Deduction, click on the magnifying glass to expand the list.

- The list of eligible programs and endowments to designate your donation has been expanded to include EVERY program and endowment at EVERY campus and system office available for designation. No need to turn in a separate form with this information!

- If you choose Goal Amount, deductions will stop once that goal has been met.

- If you choose Stop Date, your deduction will stop once that date occurs.

- If you do NOT choose a Goal Amount or a Stop Date, you deduction will continue to occur until you make an edit to it.

- Remember that deductions occur per paycheck.